Table of contents

1. Introduction

2. COVID the disruptor

3. Enter rapid customer research

4. Case study: Strategic—unlocking big ideas

5. Case study: Tactical—customer-centric design

6. Case study: B2B—Traverz Conversational Recommendation

7. Conclusion: A little certainty

1. Introduction

It’s fair to say we have become used to innovations coming along and disrupting the status quo. It’s happened very quickly in our lifetimes, but it is nothing new.

Way back in 1894, Sears launched a mail order catalogue offering a massive range, great value, convenience and customer service. It had a devastating effect on the general merchant stores. Fast forward 100 years and it was Sears’ inability to act when Amazon came along with its own version of the Sears catalogue in 1994 that led to its demise.

Then there are brands like Uber, which has had a disruptive effect on New York Cabs. Back in 2014, a taxi medallion was worth $1.3m, now it is worth $100,000.

But what do all these disruptors have in common? In fact, look at pretty much any genuinely disruptive brand and the secret is not in simply being new or different, or making use of new technology. The secret is in satisfying previously unmet customer needs, or in meeting customer needs in more convenient, satisfying or engaging ways.

What does all this have to do with research?

Well, the point is that, had the incumbent market leaders worked harder to understand their customers—not just how they behave and buy, but how they interact, understand, respond, think, feel, perceive—and acted on it, they would have been much less vulnerable to disruptive innovation.

2. COVID the disruptor

Then along came COVID-19, a new kind of disruptor. Unlike an innovator, it has not simply responded to customer needs, but fundamentally changed them.

As the chief economist at Spotify said to me recently: “Retail has reached its Napster moment.” That was the moment when everything the music industry had previously relied on ceased to be true.

Effectively, that is where we are in retail today, and will be for some time. In the space of a year, the pandemic has accelerated the digital transformation of retail by 10 years. Over that period, e-commerce penetration has risen by around 700%[i].

But this goes deeper than consumers simply shopping online more. This is a perfect storm of:

- Commercial threat—pre-COVID, 85% of retail sales were in store.

- New demographics with deep pockets really engaging with online retail for the first time.

- Fundamentally changing customer needs as consumers old and new increasingly see retail as a digital-first experience.

2.1 Evolve or die: Fixing the basics, reimagining digital

“The coronavirus pandemic represents an existential threat to the entire retail sector and there will be fundamental changes to the longer-term business model.”

Steve Sadove, former chairman and CEO of Saks

Lockdowns and stay at home orders clearly impacted on retail in the short term. With footfall down 97%, even surging e-commerce sales came nowhere near plugging the revenue gap. But the real challenge is adapting to long term change.

As Greg Petro, CEO at First Insight put it: “We as an industry have reached an ‘evolve-or-die’ moment.”

The good news is that this is something retail leaders understood almost immediately. Back in April 2020, we ran a survey to try to understand how they understood this impact. Some of their responses proved to be pretty accurate even then.

They expect the customer of the future to be:

- Financially stretched

- Wary of social contact

- Concerned about sustainability and valuing local

- Working flexibly, buying more online

- More curious digitally, and highly adaptable.

For those retail leaders that leads to two main priorities, which they themselves expressed as:

- Fixing the basics: Getting the fundamentals right—from site performance, stock, delivery and returns to the overall customer experience.

- Whilst reimagining what our digital channels might be capable of: Without that store, how do we engage our customers? The answer is to work harder to create that engagement—create digital communities, tell immersive stories, create near-sensory experiences online, inspire customers to help them select products, clienteling and selling, and 1-2-1 service.

2.2 When the past is not a guide to the future

Judging by those responses, there is clearly a commitment to innovating the customer experience at pace. However, if we accept that COVID has precipitated long term change to customer needs, then it follows that understanding those needs must be the first step.

The past is no longer a guide to the future, so the only answer now is to put the customer at the heart of everything we do.

What does that mean for retail? Quite simply, the winners in these extraordinary times will be brands that deliver (with urgency) big ideas that meet customer needs. But they will also engage with their customers in the right way, offering propositions that connect and resonate. What’s more, given the existential threat facing retailers of all shapes and sizes, it has to be rapid and it has to be right first time.

This new context means that traditional approaches to innovation and optimisation, such as lengthy customer research projects and iterative A/B testing aren’t always the best tools for the job. There just isn’t time.

3. Enter rapid customer research

All this means we need to rethink the role of customer research. If brands are to adapt and innovate with a surefooted focus on customer needs, they need rich insight, fast.

In turn, that means decoupling research from its limited role as validator at the tail end of the innovation cycle. Rather, it must be applied everywhere at pace, to shape and validate everything from big transformational ideas to tweaks and optimisations—providing the clarity and certainty retailers need to adapt quickly.

That, in a nutshell, is the role of rapid customer research. To put it in context, it’s worth briefly comparing how we might have approached a customer research programme pre-COVID, and how we are doing it now.

3.1 Out with the old …

So, by way of example, a typical research project might, in the past, have looked like this:

Event 2019 -> what can we learn from last year to improve performance this year -> Event 2020

The event might be back to school, Black Friday and so on, but the process is essentially the same—to look back at 2019 and understand what we should do in 2020. That would typically have been an eight-week (300 hour) process. It would include customer interviews, quantitative surveys, and data analysis to really understand what happened.

Overall, the aim would be to assess the messaging, the creative, the overall proposition, and the products as well to some extent, to understand how it went and what we could do better.

3.2 … in with the new

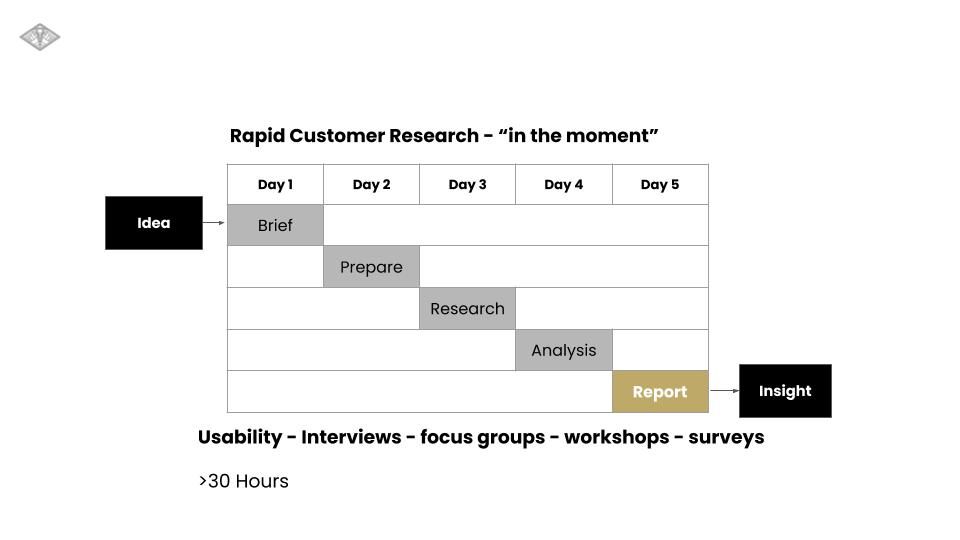

Now, however, as typical research process might look this:

Idea -> brief – prepare – research – analyse – report -> Insight

Rapid customer research has the potential to be carried out in the moment—in the moment something is happening. That doesn’t mean the insight is any less rich. We can still include usability studies, interviews, focus groups, workshops and surveys—a mixture of quantitative and qualitative research.

The difference is two-fold. First, this is not about looking back and learning. It is about testing ideas, campaigns strategies, pretty much anything, at the outset. The goal is to understand likely customer responses and use that insight to shape everything that follows.

The second is the speed at which we can do it. The whole thing can be done in less than 30 hours. To put that in context, in the time it took to carry out one research project in 2019 we completed 11 research projects and started three more in 2020.

3.3 A broader role for research

The critical role of customer research in adapting to a world disrupted by COVID has not gone unnoticed by our customers. Aided by the speed at which we can deliver insight, we are being asked to apply customer research much more broadly.

We’re being asked to uncover:

- How customers see things

- How they interact with things

- What they understand about things

- How they respond to things

- What they think and feel about things

- What they perceive and what decisions they make.

We’re being asked to understand all those aspects of customer behaviour when presented with a whole range of things—from the tactical, like campaigns, right through to the strategic, like brand perception.

To illustrate that, here are just a few examples of the topics and issues we have been asked to research in recent months:

- Sustainability messaging: Do people notice sustainability messaging? What impact does it have on them? How do they perceive it, and how does it change their perception of the brand?

- Loyalty schemes: How do customers understand and perceive the benefits of membership and loyalty schemes? How do they affect behaviour?

- Technology in apparel: How do people respond to technology—in this case training shoe technology? Do people understand it and its benefits, and do they value it as a consequence?

- Product naming: Do people understand product names? Especially when product names include quite technical details—how do customers respond?

- Photography: How do customers respond to product photography? We’ve done a lot of work on model poses—looking at the impact of different poses for different categories.

- The basics: Looking at things that in the past have seemed a little mundane but which are critical right now. Sizing information, returns, refunds and so on.

3.4 Informed decisions

Crucially, the insight from that research is not designed to test innovations that are already well along the development path. Now, research is the basis for informed decisions about what those innovations should be in the first place.

This is the very essence of customer-led innovation. It is also the only way to adapt with any certainty when facing that Napster moment when ‘everything an industry had previously relied on ceases to be true.’

On top of all that, we can apply rapid customer research techniques in all kinds of contexts:

- Big transformative ideas that are so hard to get off the ground but must now be delivered with urgency.

- The tactical—from campaigns to optimisation.

- Cases where consumers are one step removed—like business to business innovation.

4. Case study: Strategic—unlocking big ideas

A global apparel brand approached us with some big concepts which it hoped would transform elements of the customer experience. Clearly, of course, these would all be significant pieces of work—longer-term, strategic with price tags to match. What the brand wanted was some real direction strategically about where to focus and when.

4.1 The research

The answer was to ask—to carry out rapid customer research even at such an early stage. That meant using basic visual representations of those ideas, accompanying them with competitor examples and running moderated customer interviews.

Remember here that customer research doesn’t always need to be based on anything approaching a final idea, concept or design. In this case, we just needed to get the idea across to the customer. We were looking for evidence of likely impact, not for granular detail around design treatment or usability.

Rather, the aim was to understand which parts of those experiences were worth pursuing and begin to identify whether elements of those experiences would need to be handled in a certain way.

4.2 The outcomes

Crucially, that process of sketching ideas, testing, interviewing and analysis is quick, and the outputs are incredibly helpful:

- The brand learned which of those big ideas were worth pursuing—based not on ’gut feel’ but on detailed customer feedback.

- It learned enough to be able to prioritise, selecting the ideas most likely to make the biggest positive impact first.

- Customer interviews also started to tell us about execution—the approaches that prompt the biggest response, where in the journey to surface them and so on.

So, very quickly the brand moved on from a position where it had these ideas and concepts, but no idea how or when to tackle them. Now it had some tangible insight as to where the priorities should be and a head start in terms of execution.

Of course, that customer-centric approach shouldn’t end there. It should continue throughout design and development work. The good news is that rapid customer research is just as applicable there.

5. Case study: Tactical—customer-centric design

It would be very easy to get that strategic insight, then fall back into the old ways: To build elements of these new experiences and an A/B test at the end. But why should the role of customer insight end there?

Rapid customer research is just applicable later in the process, as a global sportswear brand recently discovered.

In this case, our client wanted to incorporate rapid customer research in the sprint cycle, prior to A/B testing. So, for instance, the design team has a draft design, but a knowledge gap as to whether it is going to hit the mark.

5.1 The research

In response, we worked together to inject rapid customer research into that process. It was a seamless programme of research that, again, removed uncertainty from experience innovation.

Simply, we took briefs on quite specific designs, wrote scripts for unmoderated online tests, harvested, analysed and organised the findings, and reported back. The whole process for each takes around three days.

5.2 The outcome

In this case, rapid customer research helped in a couple of notable ways:

- First, it ensured the customer feedback loop stayed in place in the tactical execution phase—to validate even the smallest details.

- And second, it made even this tactical work more efficient. Rather than relying on A/B testing, which tells us which option is better, but not why it tells us which is most likely to perform best and why. Then A/B testing is the final, commercially focused validation of that work, rather than the only validation.

6. Case study: B2B—Traverz Conversational Recommendation

The benefits of rapid customer research are not limited to B2C brands. When Traverz developed its ‘Conversational Recommendation Technology’, the team believed it would drive a “paradigm change in product search” by enabling a more personalised experience than traditional on/off filters.

However, convincing retailers of the merits of a radically new approach to product search requires more than a demo. They want to understand the likely commercial impact. In turn, means understanding the impact on customer behaviour—from purchase intent to loyalty.

6.1 The research

To deliver that insight we worked with Traverz to design a customer research programme combining one to one moderated sessions and surveys across two days.

Users were asked to complete task-based journeys on two of Traverz’ demo sites. The aim was to deliver credible independent verification of Traverz’ claimed benefits by gathering user feedback on the experience. We used benchmark polling to capture net promoter scores, experience and intent ratings on:

- The standard filter experience prior to exposure to Traverz

- The Traverz experience

- The standard filter experience after exposure to Traverz

6.2 The outcome

It was not our role to endorse the Traverz proposition or otherwise, but to provide the independent research expertise required to test the efficacy of its Conversational Recommendation approach—to let the findings speak for themselves.

That said, it is not a stretch to conclude that our research revealed a significant consumer preference for the Traverz experience. The outcome was a powerful validation of its proposition for retailers that is now at the heart of Traverz’ go-to-market strategy and messaging.

7. Conclusion: A little certainty

Clearly, rapid customer research can’t offer any guarantees. Every research project must still be clearly focused, intelligently designed and well-executed. Done well, however, it can make a huge difference to both the pace and the impact of innovation.

That’s because gathering customer insight to shape the direction much earlier and at every step along the way gives brands more reason to believe in a particular approach. It increases the innovation strike rate because innovation no longer happens in isolation. Instead, it is shaped by insight around customer needs and preferences from a very early stage.

In truth, this is about much more than research. It’s about a mindset change. Being continually customer informed both strategically and tactically—building in alignment to the customer at all stages of innovation to ensure, as far as possible, that the end result is something customers are going to respond to positively.

I firmly believe that, in these extraordinary times, rapid customer research will prove the crucial differentiator between those who adapt successfully and at pace, and those that are left behind. Customer insight brings certainty and direction to experience innovation and, if there is one thing we all need at the moment, it is a little certainty.

_____________________________________